Buying a house is a big dream for many people. It’s a place to call your own, a place to build memories. But it also comes with a lot of questions, especially when it comes to money. One question that often pops up is: Does Food Stamps Affect Buying A House? Let’s dive in and figure this out, looking at how food assistance might play a role in this important financial decision.

What Food Stamps Are, and How They Work

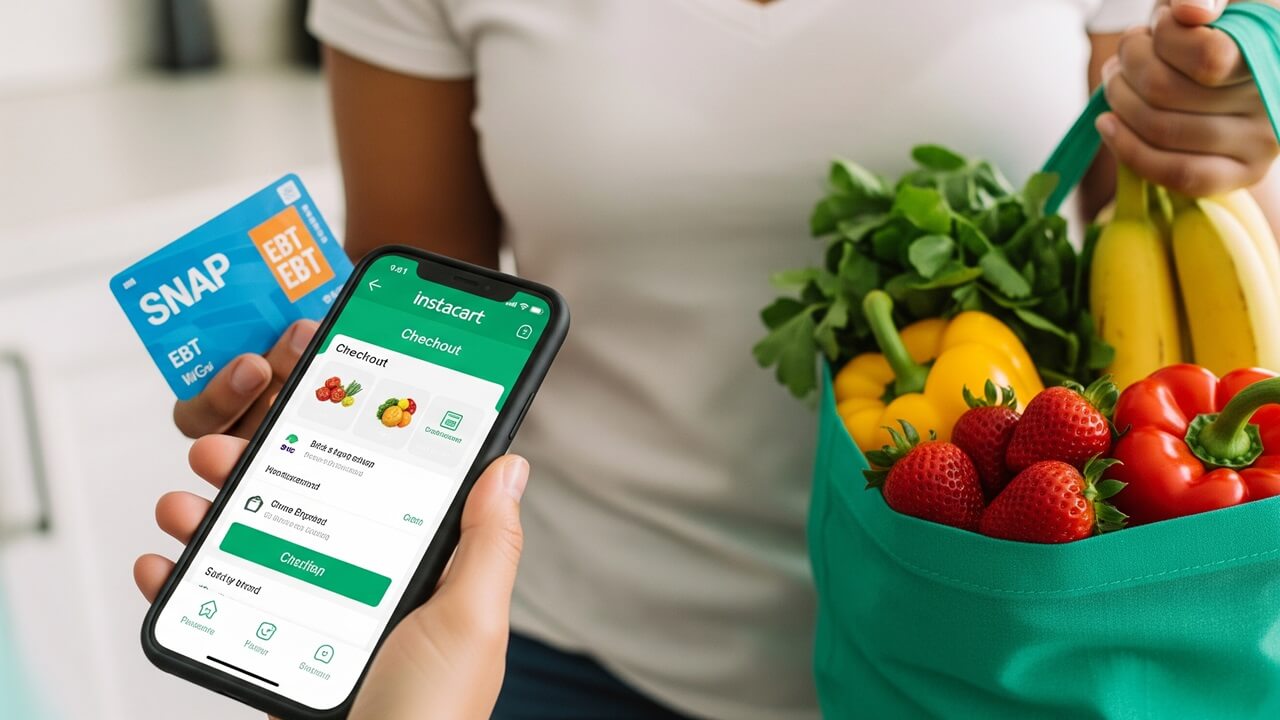

First, let’s quickly understand what Food Stamps are. Officially called the Supplemental Nutrition Assistance Program (SNAP), they help people with low incomes buy food. Families and individuals who qualify receive money each month on an Electronic Benefit Transfer (EBT) card, which works like a debit card at most grocery stores. This helps them afford healthy meals and groceries, taking some pressure off their budgets.

Now, imagine you’re planning to buy a house. You’ll need to save money for a down payment and closing costs. Also, lenders look closely at your income, your debts, and your spending habits to figure out if you can handle a mortgage. Food stamps directly affect the amount of money you have to spend on food. They free up money in your budget.

If you receive food stamps, it means the government is helping you with your food expenses. This can free up money in your budget to spend on other expenses, like saving for a down payment on a house. However, receiving food stamps in itself is not a direct cause for a negative outcome when trying to get a mortgage. However, it might indirectly impact things. But food stamps don’t disqualify you from buying a house. The important thing is how much money you have left over after paying your expenses.

So, in simple terms: Receiving food stamps, in itself, doesn’t automatically stop you from getting a mortgage. Instead, the lender focuses on your total financial situation, including your income, debts, and savings, and how you manage your money.

Income and Affordability

When you apply for a mortgage, lenders want to make sure you can afford to pay back the loan. They look at your income to see how much you earn. If you are receiving food stamps, it doesn’t increase your income. Mortgage lenders look at your verifiable income, such as your job earnings, and possibly any other income streams you may have.

Lenders use two main ratios to figure out how much you can afford to borrow:

- The front-end ratio: This compares your potential monthly housing costs (mortgage payment, property taxes, and homeowner’s insurance) to your gross monthly income.

- The back-end ratio: This compares your total monthly debt payments (including the potential mortgage payment) to your gross monthly income.

The amount of income a potential buyer has is very important for getting approved. However, food stamps won’t raise your income. It does free up money in your budget that you may be able to use in the other areas like your down payment, or potential closing costs. The more money you have, the better your chances of being approved for a mortgage.

Also, it’s important to understand the potential impact of having different sources of income.

- Employment Income: This is the main source, from a steady job.

- Other income sources: These could include child support payments, alimony, and Social Security income.

- Food Stamps: While food stamps don’t directly count as income, they help manage your other finances.

Debt-to-Income Ratio

Lenders pay close attention to your debt-to-income ratio (DTI). This ratio compares how much you owe each month to how much you earn. It’s a key factor in determining whether you can afford a mortgage. High DTI ratios mean you have a lot of debt compared to your income, which can make it harder to get approved for a loan.

Food stamps themselves aren’t considered debt, so they don’t directly affect your DTI. However, food stamps are there to help reduce your expenses. So, a lower DTI could be a benefit. For example, let’s say you spend $500 a month on food. When you receive food stamps, that $500 is free to use in your monthly budget. This in turn could reduce the debt that you carry.

Here’s how debt can affect your ability to buy a house:

- Credit Card Debt: High credit card balances increase your monthly debt payments, hurting your DTI.

- Student Loans: These can also add significantly to your monthly debt obligations.

- Car Loans: Similar to credit cards and student loans, car payments increase your DTI.

The lower your DTI, the more likely you are to be approved for a mortgage. Keeping your debt under control is a smart move when buying a house, regardless of whether you receive food stamps.

Savings and Down Payments

Saving money for a down payment is one of the biggest hurdles in buying a house. The more you save, the more you’ll have to put down, which can lower your monthly mortgage payments and potentially the interest you pay over the life of the loan. While food stamps do not directly translate into savings, they allow you to spend less of your money on food. Less spending on food in turn can mean you have more money left over.

Here’s what you might save for your down payment:

- Down Payment: The initial amount you pay upfront.

- Closing Costs: Fees associated with the mortgage process, such as appraisal fees and title insurance.

- Emergency Fund: A financial cushion to cover unexpected expenses.

Let’s say you budget $600 per month for groceries but instead receive $600 in food stamps. The $600 can then be used for other expenses. So, if you previously put $200 into your savings, now you can put $800 into your savings. This savings will allow you to purchase a house easier.

Having food stamps frees up cash in your monthly budget, which can then be saved toward the down payment. The size of your down payment can also influence the type of mortgage you can get and the interest rate you’ll pay. The more you can save, the better!

Credit History and Score

Your credit history and credit score are major factors for mortgage approval. Lenders use your credit score to assess how well you manage your finances and how likely you are to repay a loan. A good credit score can get you better interest rates and terms. Food stamps don’t directly affect your credit score, but the financial habits you have can affect your credit score.

Here’s what lenders look for in your credit history:

- Payment History: Do you pay your bills on time?

- Credit Utilization: How much of your available credit are you using?

- Length of Credit History: How long have you had credit accounts?

- Types of Credit: Do you have a mix of credit accounts (credit cards, loans)?

A good credit score opens the door to better mortgage terms, like lower interest rates. The better your credit history, the more options you’ll have. While food stamps don’t directly improve your credit score, by managing your finances wisely, you will be better prepared for the home buying process.

Here is a simple table to give you some examples of how you can improve your credit score:

| Bad Habits | Good Habits |

|---|---|

| Missing Payments | Paying Bills on Time |

| Maxed out Credit Cards | Keeping Credit Card Balances Low |

| Ignoring Credit Report Errors | Reviewing and Fixing Credit Report Errors |

Mortgage Programs and Food Stamps

There are different types of mortgages available, such as FHA loans, VA loans, and conventional loans. Each loan program has its own set of requirements, including income and credit score criteria. Some of these loans are specifically designed to help first-time homebuyers or people with lower incomes. Food stamps don’t automatically restrict you from getting a certain type of mortgage, but your overall financial situation will matter.

Here’s a quick look at some popular mortgage programs:

- FHA Loans: These loans are insured by the Federal Housing Administration and often have more flexible credit requirements.

- VA Loans: These loans are for veterans and active-duty military members and typically offer favorable terms.

- Conventional Loans: These loans are not backed by the government and generally require a higher credit score and larger down payment.

You should speak with a mortgage lender to discuss your situation. The lender can assess your income, credit history, and other factors to recommend the best mortgage options for you.

Here is a chart of different mortgage options, to help you learn the different programs:

| Mortgage Type | Typical Requirements |

|---|---|

| FHA Loans | Lower Credit Score, Smaller Down Payment |

| VA Loans | For Veterans/Military, No Down Payment Required |

| Conventional Loans | Higher Credit Score, Larger Down Payment |

Seeking Professional Help

Navigating the home-buying process can be tricky, and it’s a good idea to get some help. A good first step is to talk to a mortgage lender or a loan officer. They can explain the different types of loans available, assess your financial situation, and guide you through the application process.

Here are professionals who can help:

- Mortgage Lenders/Loan Officers: They will assess your finances.

- Real Estate Agents: They will help you find a home.

- Financial Advisors: These can help with budgeting and planning.

These professionals can offer tailored advice based on your unique circumstances, including any financial assistance you receive. You can find resources that provide guidance and education. Being well-informed empowers you to make smart decisions, set financial goals, and take steps toward homeownership.

It’s wise to consider these points:

- Create a realistic budget

- Improve Your Credit Score

- Save as much money as possible

Here’s a checklist to help you prepare:

- Review your credit report

- Create a budget

- Contact a mortgage lender

Conclusion

So, to wrap things up, Does Food Stamps Affect Buying A House? Not directly. Food stamps don’t automatically prevent you from getting a mortgage. However, your overall financial picture matters, including income, debts, savings, and credit history. Food stamps help with food costs, but don’t raise your income. By managing your money wisely, saving for a down payment, and maintaining good credit, you can increase your chances of buying a home, regardless of whether you receive food stamps. Remember to talk to professionals for personalized guidance on your home-buying journey!